what is the percentage of taxes taken out of a paycheck in colorado

Do this later. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time.

Individual Income Tax Colorado General Assembly

For the 2019 tax year the maximum income amount that can be subjected to this tax is 132900.

. Helpful Paycheck Calculator Info. Similarly you may ask what is the Colorado state income tax rate for 2019. Colorado tax year starts from July 01 the year before to June 30 the current year.

This Colorado hourly paycheck calculator is perfect for those who are paid on an hourly basis. Total income taxes paid. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches.

If you earn a fixed salary this is easy to figure out. Switch to Colorado hourly calculator. For 2022 the Unemployment Insurance tax range is from 075 to 1039 with new employers generally starting at 17.

Calculating in-handtake home salary. For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado paycheck calculator.

Social Security tax. Only the Medicare HI tax is applicable to the remaining four pay periods so the withholding is reduced to 6885 x 145 or 9983. It changes on a yearly basis and is dependent on many things including wage and industry.

You pay the tax on only the first 147000 of your earnings in 2022. Figure out your filing status. Colorado Unemployment Insurance is complex.

If your taxable income was 50000 in 2020 you would calculate your federal tax as follows. Colorado income tax rate. How do I figure out my take home pay.

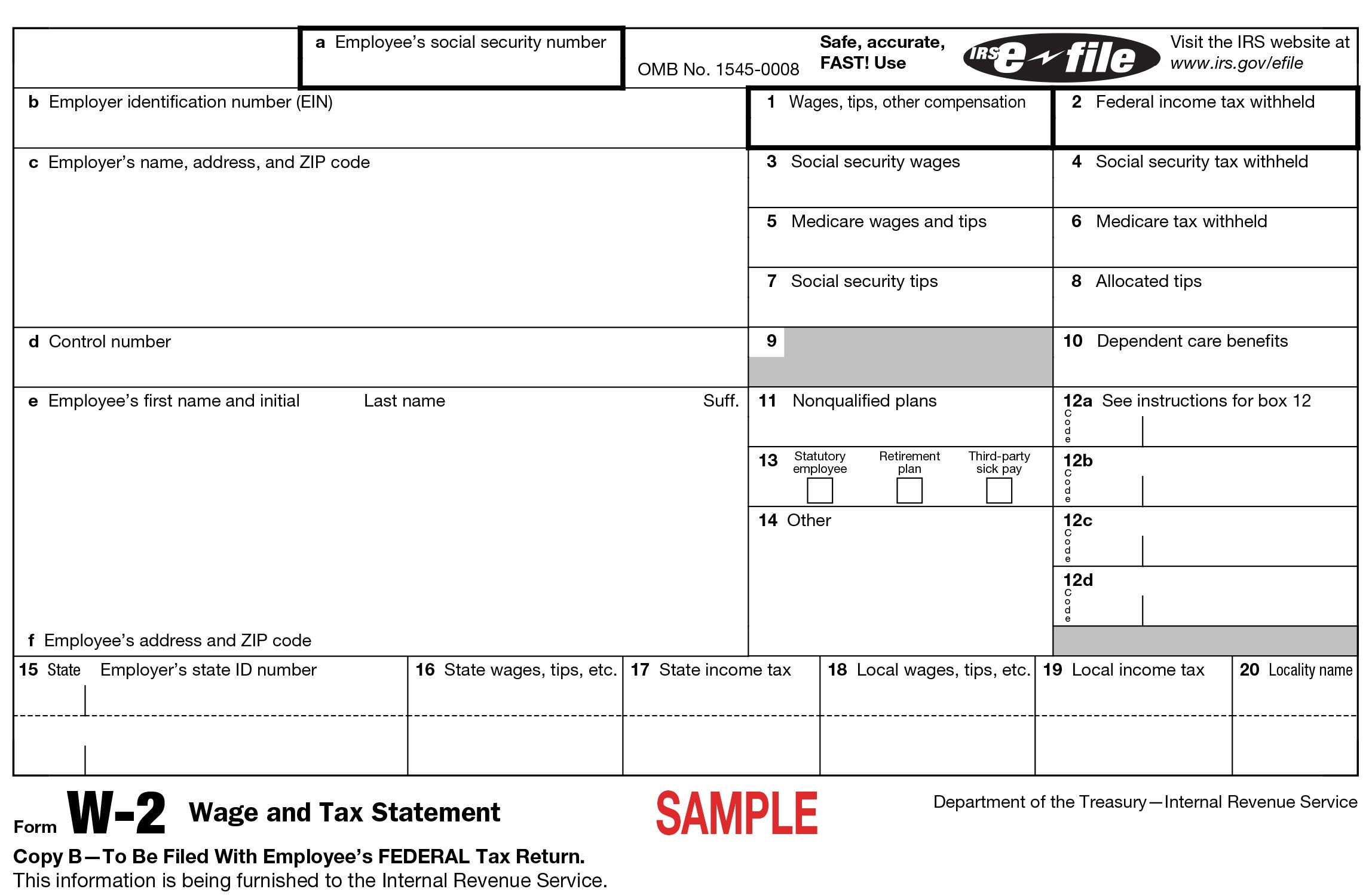

Every employer must prepare a W-2 for. Since 142800 divided by 6885 is 207 this threshold is reached after the 21st paycheck. For example if you want 60 taken out of each paycheck on top of the dollar amounts youve entered for the tax year then all you need to.

There is a wage base limit on this tax. Total income taxes paid. Colorado income tax rate.

Just enter in the required info below such as wage and W-4 information and our tool will perform the necessary calculations. Both employee and employer shares in paying these taxes each paying 765. For Medicare taxes 145 is deducted from each paycheck and your employer matches that amount.

Amount taken out of an average biweekly paycheck. It is not a substitute for the advice of an accountant or other tax professional. And if youre in the construction business unemployment taxes are especially complicated.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. This is divided up so that both employer and employee pay 62 each. Colorado Paycheck Quick Facts.

Calculating your Colorado state income tax is similar to the steps we listed on our Federal paycheck calculator. Calculate income tax Step 4. 672 More From GOBankingRates.

Colorado Paycheck Quick Facts. For self-employed individuals they have to pay the full percentage themselves. For 2022 the limit for 401 k plans is 20500.

215 Amount taken out of an average biweekly paycheck. Use ADPs Colorado Paycheck Calculator to calculate net take home pay for either hourly or salary employment. For the first 20 pay periods therefore the total FICA tax withholding is equal to or 52670.

So the tax year 2021 will start from July 01 2020 to June 30 2021. All data was collected on and up to date as of Jan. At the time of publication the employee portion of the Social Security tax is assessed at 62 percent of gross wages while the Medicare tax is.

Its important to note that there are limits to the pre-tax contribution amounts. Just divide the annual amount by the number of periods each. A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation.

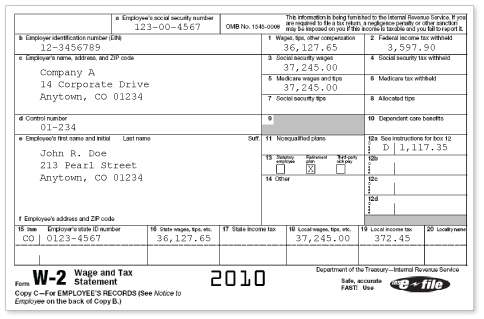

The amount of your gross pay. Employers are required to file returns and remit tax on a quarterly monthly or weekly basis depending on the employers total annual Colorado wage withholding liability. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

The Colorado Withholding Worksheet for Employers DR 1098 prescribes the method for calculating the required amount of withholding. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Colorado residents only. Elected State Percentage.

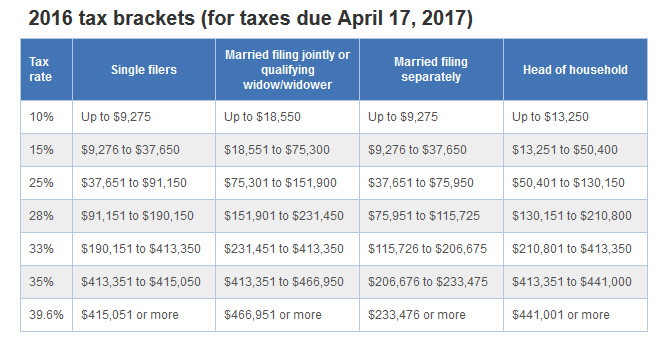

For a single filer the first 9875 you earn is taxed at 10. How much taxes are taken out of a 1000 check. Colorado Hourly Paycheck Calculator.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Only the very last 1475 you earned would be taxed at. Colorado tax year starts from July 01 the year before to June 30 the current year.

Both employee and employer shares in paying these taxes. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

Colorado has a straightforward flat income tax rate of 455 as of 2021. These are contributions that you make before any taxes are withheld from your paycheck. The Colorado bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Colorado Salary Paycheck Calculator. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Any income exceeding that amount will not be taxed.

2813 Amount taken out of an average biweekly paycheck.

Here S How Much Money You Take Home From A 75 000 Salary

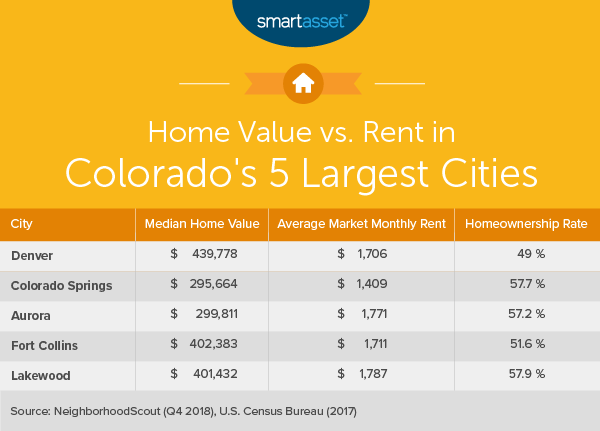

Colorado Estate Tax Everything You Need To Know Smartasset

2022 Federal State Payroll Tax Rates For Employers

Individual Income Tax Colorado General Assembly

Colorado Paycheck Calculator Smartasset

Math You 5 4 Social Security Payroll Taxes Page 240

Colorado Paycheck Calculator Smartasset

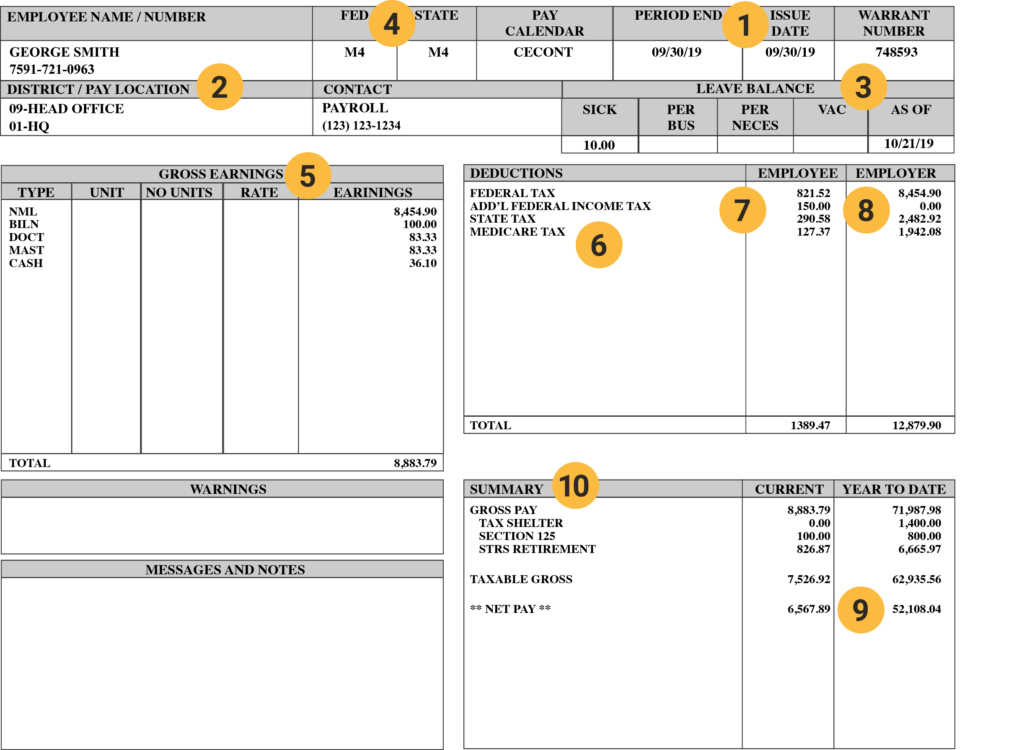

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Individual Income Tax Colorado General Assembly

Individual Income Tax Colorado General Assembly

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Understanding Your Pay Statement Office Of Human Resources

How To Read Your W 2 University Of Colorado

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

Clinical Phlebotomist Salary In Colorado Springs Co Comparably

The Cost Of Living In Colorado Smartasset

How Much Should I Set Aside For Taxes 1099